We’ve all been there. Your client calls in a frenzy demanding to know what medical coverage (if any) he has for an upcoming vacation abroad. You’ve gotten this question before, but you pause to answer. It’s a complicated grey area because there are almost no benefit standards attached to covering members overseas, unlike the Affordable Care Act.

The 10 Essential Health Benefits essentially go out the window once your client departs the United States. The coverage and access to networks overseas vary among the group, individual, and government plans. And they vary markedly among insurance carriers. Further compounding the issue, length of travel and low lifetime limits can be a factor, particularly for Medicare supplemental policies.

So how do you provide a black and white answer in this grey area? Practically speaking, U.S. domestic health insurers typically provide scant international medical coverage for globally mobile members. In addition, plans customarily contract from comprehensive coverage to catastrophic only. As a result, Americans abroad often find themselves underinsured or not insured at all (e.g., your client moved to France and is no longer living, working, or studying in the plan service area).

Additionally, members can be left to their own devices to find medical professionals. Without access to vetted international providers, members relying on their domestic health insurance often have a poor patient experience due to limited understanding of the physician’s accreditation and training, payment preferences, or even what to expect upon arrival.

Domestic carriers are not all the same.

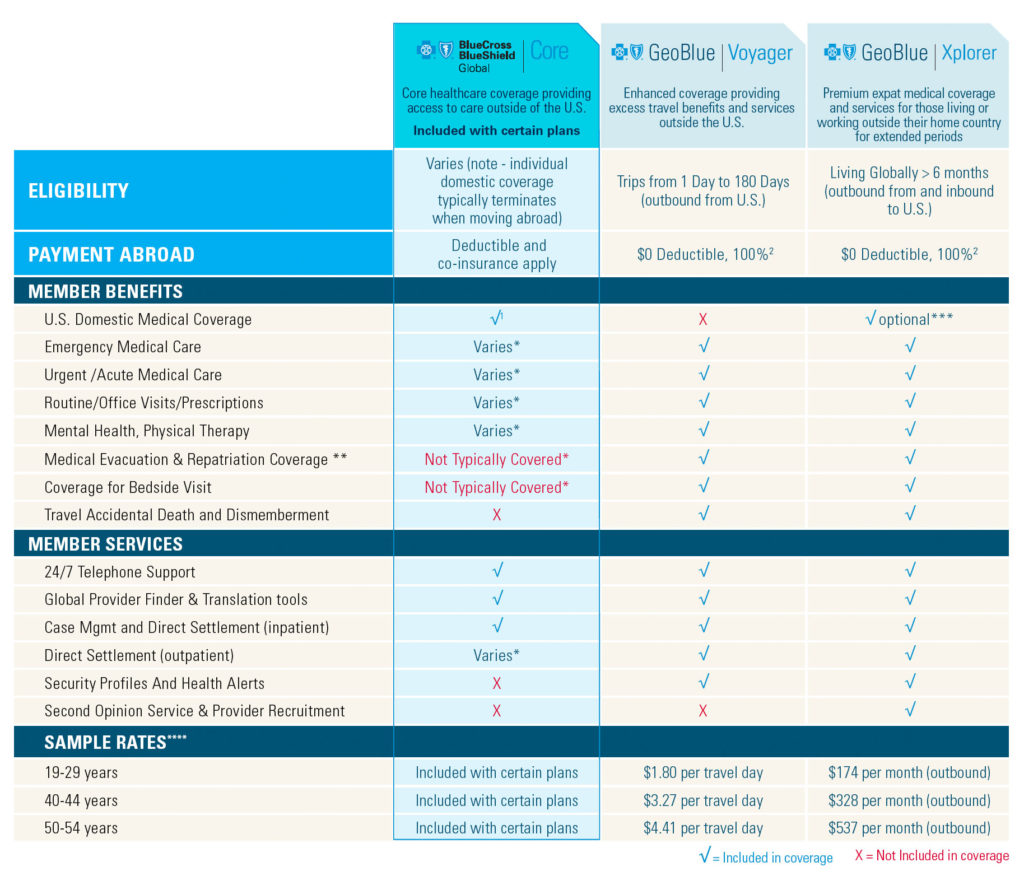

Blue Cross Blue Shields plans offer a suite of international health insurance solutions designed to meet the needs of globally mobile individuals worldwide. In addition, most BCBS plans embed a free program called Blue Cross Blue Shield Core, formerly referred to as Bluecard Worldwide, which provides basic coverage and assistance (see comparison grid on the back of this sheet).

In even better news, GeoBlue offers affordable extended coverage through travel health products that offer enhanced benefits, support, security, and convenience for anyone planning trips abroad or living outside of the U.S. for an extended period.

GeoBlue plans bridge coverage gaps and is engineered for international traveler needs. Your customers will receive concierge-level service to help them navigate different health systems across the globe:

• Access to 24/7 assistance services

• Access to a hand-selected contracted global provider network

• Clear, extensive evacuation/repatriation coverage and AD&D

• Direct pay – meaning a cashless experience with no costly upfront payments for care

• Valuable digital tools, including security profiles that help empower members

Visit the Agent Hub for customizable materials to share with your customers!

Below is a comparison of the Blue Cross Blue Shield international solutions available.

* Check with Local Plan to determine coverage options ** Deductible variations available *** Optional U.S. domestic overage for Xplorer plan increases pricing more than 2 times the reflected outbound monthly rates. Coinsurance is 80% in-network and 60% out of network in the U.S.; Preferred rates are valid as of 7/1/17 and are subject to change without notice **** Voyager rates reflect $1M medical limit (note – 7 Day minimum charge).

Frequent travelers may consider multi-trip coverage under the GeoBlue Trekker product (not shown) 1 Domestic coverage prerequisite – Blue Cross Blue Shield Global Core provided in conjunction with applicable BCBS domestic policies 2 Coverage based on listed benefit in the insurance certificate.

GeoBlue is the trade name of Worldwide Insurance Services, LLC (Worldwide Services Insurance Agency, LLC in California and New York), an independent Blue Cross and Blue Shield Association licensee. The administrator of coverage is provided under insurance policies issued by 4 Ever Life International Limited, Bermuda, an independent licensee of the Blue Cross Blue Shield Association.

BCBS is a brand owned by the Blue Cross and Blue Shield Association. It is an association of independent Blue Cross and Blue Shield companies.

Thank you for your continued support!

Questions?

Contact Partner Program